CREDIT CARD SETTLEMENT

What Exactly Is Credit Card Settlement?

Credit Card Settlement is a legally recognized negotiation process where the bank agrees to

close your overdue credit card account at a reduced amount due to your financial hardship.

Instead of paying the entire outstanding—which includes high interest, penalties, late fees, GST,

and over-limit charges—the bank allows you to pay a mutually agreed one-time settlement

amount. After payment, the remaining balance is waived off completely, and the bank issues a

No Dues Certificate (NOC) confirming closure.

This solution is ideal for people who want a safe, structured, and lawful way to become

debt-free.

Why Do Banks Agree to Settlement?

Banks follow RBI-guided frameworks for handling overdue accounts. When a customer is

unable to repay due to genuine financial issues—job loss, salary reduction, business loss,

medical emergency, etc.—banks prefer settlement over:

Continuous operational cost

High recovery expenses

Legal escalation

Risk of the loan turning into a complete loss

Settlement helps banks recover some amount quickly while giving you a chance to reset

financially.

When Should Someone Consider Credit Card Settlement?

You should consider settlement if:

- You’re 60–90+ days overdue (DPD)

- Interest and penalties have skyrocketed

- You cannot manage minimum monthly payments

- Recovery agents are calling repeatedly

- You’re struggling due to financial hardship

- You want to avoid legal notices or escalations

- You want a one-time permanent resolution

For someone stuck in increasing credit card debt, settlement is often the most practical and

safest path.

The Complete Credit Card Settlement Process (Step-by-Step)

Financial Assessment & Case Study

We examine:

- Total outstanding across all cards

- Days Past Due (DPD)

- Current income & liabilities

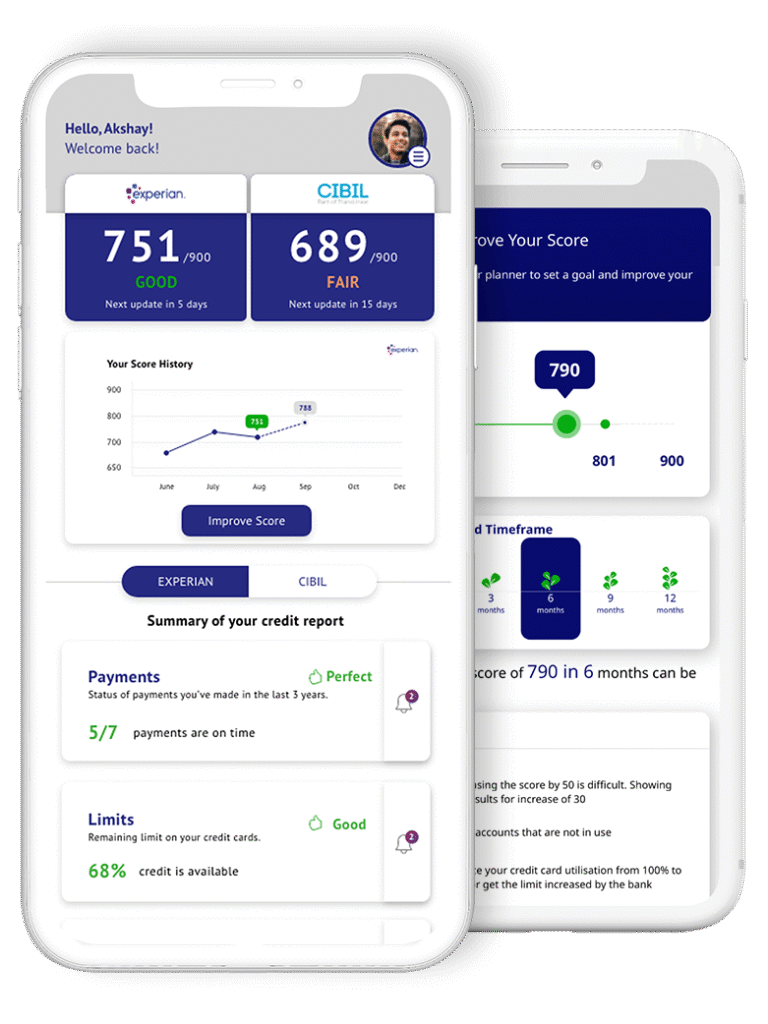

- Credit report (CIBIL/Experian)

- Hardship reason

- Repayment history

This helps determine the ideal settlement range

Legal Protection & Call Management

Once onboarded:

- All recovery calls are redirected to our team

- We issue a legal intimation to the bank

- RBI recovery guidelines are activated

- Harassment and threats stop immediately

This gives clients instant emotional relief.

Settlement Eligibility & Calculation

We calculate:

- How much reduction is possible

- What amount the bank is likely to accept

- Whether one-time or split settlement is feasible

- A strategic negotiation plan

Most settlements fall between 25%–45% of outstanding, depending on bank policy & DPD.

Contacting the Bank / Recovery Team / Nodal Officer

Your dedicated advisor coordinates with:

- Bank’s debt recovery team

- Authorized collection agencies

- Grievance redressal department

- Principal Nodal Officer (PNO), if needed

Proper documentation is used to initiate formal negotiation.

Negotiation for Maximum Waiver

We negotiate for:

- Maximum interest waiver

- Maximum penalty waiver

- Reduction of principal amount (case-to-case)

- Longer settlement window (if required)

- Written commitment from the bank

No payment is made until the bank issues an official Settlement Letter.

Settlement Payment & Closure

Once approved:

- You pay directly to the bank (never to any agent)

- UPI/NEFT/RTGS/Cheque/DD — based on bank policy

- Payments are acknowledged in writing

Your account status is updated

Obtaining NOC & Improving CIBIL

After completion:

- Bank issues a No

- Dues Certificate (NOC)

- Recovery activities stop permanently

- CIBIL shows the account as “Settled”

- We guide you in rebuilding CIBIL to 700+ within 6–12 months

This ensures long-term financial recovery.

Is Credit Card Settlement Legal?

YES — it is completely legal.

It is supported by:

RBI guidelines on recovery & restructuring

Official settlement policies of all major banks

Banking Ombudsman regulations

Credit card settlement is an accepted, formal banking solution for customers in genuine financial

difficulty.

Benefits of Credit Card Settlement

✔ Pay only a portion of your total dues

✔ Stop recovery harassment immediately

✔ Avoid legal escalation

✔ Reduce financial stress

✔ Resolve dues faster

✔ Receive proper documentation (Settlement Letter + NOC)

✔ Begin fresh with a clean financial path

Impact on CIBIL Score

Status is updated as “Settled”

Score may drop initially

With our structured rebuild plan, clients typically recover to 700+ within months

A one-time settlement is far better than a long-term default.

Documents Required

Aadhaar & PAN

Latest credit card bill

Credit report (CIBIL/Experian)

Recovery messages / notices

Hardship proof (optional)

💬 FREQUENTLY ASKED QUESTIONS (FAQs)

Yes. It is a fully legal and recognized process used by all major banks in India to close overdue

accounts through negotiation.

Yes, temporarily. The account will reflect as “Settled.”

However, with proper financial discipline and guidance, scores can be rebuilt within 6–12

months.

Most cards can be settled after 60–90 days of overdue, depending on the bank’s policy and your

financial condition.

No. The entire negotiation process is managed by our experts. You only make the final payment

directly to the bank.

Yes. We take over all communication. Recovery calls, threats, and harassment stop immediately

once legal intimation is issued.

We create a consolidated settlement plan and negotiate with each bank individually for the best

possible reduced amount.

If you cannot afford regular payments and dues are increasing due to interest, settlement is the

smartest and most cost-effective solution.

The bank issues a No Dues Certificate (NOC), closes your card permanently, and updates your

CIBIL.

Yes, after rebuilding your score. Many clients qualify for loans within 12–18 months with proper

guidance.

No. It depends on DPD, financial hardship, lender policies, and negotiation quality.