AUTO LOAN SETTLEMENT

What Is Auto Loan Settlement?

Auto Loan Settlement is a formal negotiation process where the bank or NBFC agrees to close your overdue vehicle loan (car, bike, commercial vehicle) at a reduced amount, considering your financial hardship and repayment inability.

Unlike repossession or auction, which are stressful and time-consuming, settlement provides a

safe, legal, and quick resolution where:

- You pay a negotiated portion of your total outstanding

- The remaining balance is waived off

- The loan is marked closed

- The bank issues a No Dues Certificate (NOC)

This method helps borrowers who can no longer manage EMIs due to genuine financial

difficulties.

Why Banks Offer Auto Loan Settlement

Banks prefer settlement when recovery becomes difficult or costly.

Banks/NBFCs agree to settlement when:

- EMIs remain unpaid for 60–180+ days

- The account is heading toward NPA

- Vehicle repossession attempts fail or are not feasible

- Borrower cannot pay due to job loss or income downfall

- Vehicle value has depreciated significantly

- Litigation is costly and time-consuming

Settlement is beneficial for both sides

For Banks:

- Quick lump-sum recovery

- Lower legal & repossession costs

- Reduced NPA burden

For Borrowers:

- Lower payoff amount

- Protection from repossession

- Stress-free legal closure

- Avoiding long-term harassment

When Should Someone Consider Auto Loan Settlement?

Auto loan settlement is ideal for borrowers who:

- Are 60–180+ days overdue (DPD)

- Are unable to continue EMIs

- Have received repossession or legal warning

- Are facing severe financial hardship

- Have lost a job, business, or income source

- Cannot regularize the overdue amount

- Want a one-time closure at a reduced cost

- Fear vehicle seizure or legal action

If repayment is impossible, settlement is often the safest and most practical solution.

Types of Auto Loan Settlement

One-Time Settlement (OTS)

Most common method.

Bank offers a reduced settlement amount, payable within a fixed timeline

Compromise Settlement

Applicable when:

Borrower has no repayment capacity

Vehicle condition is poor

NPA is long-standing

Legal recovery is costly

Bank accepts the maximum possible amount borrower can offer.

Post-Repossession Settlement

If the bank has already seized the vehicle:

Vehicle is auctioned

If auction sale value is less than loan outstanding

Remaining deficit (shortfall amount) can also be settled

The Auto Loan Settlement Process (Step-by-Step)

Complete Loan Assessment

We review:

- Outstanding loan amount

- EMI history

- DPD / NPA classification

- Vehicle value (current market)

- Recovery notices

- Financial hardship reasons

- Repossession status (if any)

This helps us calculate the feasible settlement range.

Legal Protection & Stopping Harassment Calls

Once onboard:

- We issue a legal representation to the lender

- Illegal towing/recovery attempts are stopped

- RBI recovery guidelines are enforced

- Borrower gets immediate relief from harassment

Calculating Settlement Window

We determine:

- Minimum amount the bank may accept

- Maximum waiver possible

- Whether EMI restructure or top-up is feasible

- Whether vehicle value supports settlement

Auto loan settlements usually fall between:

- 40% – 70% waiver, depending on DPD

- Vehicle condition

Hardship proof - Bank/NBFC policy

Negotiation With Bank / Recovery Team / Nodal Officer

We professionally communicate with:

- Bank’s recovery manager

- Loan collections department

- Authorized repossession teams

- Branch manager

- Nodal Officer (for escalations)

Proper representation ensures faster approval.

Negotiation for Maximum Reduction

Our legal team negotiates for:

- Waiver of interest

- Waiver of late fees and penalties

- Waiver of legal charges

- Principal reduction (in hardship cases)

- Flexible payment timeline

No payment is made until a written settlement offer is received.

Settlement Payment to Bank

Once approved:

- Payment is made directly to the bank

- Acknowledgment receipt is collected

- Loan is marked as settled

- If vehicle was repossessed:

- Settlement closes the shortfall amount

No further legal recovery remains

NOC, CIBIL Update & Vehicle Release (If Applicable)

After completion:

- Bank issues a No Dues Certificate (NOC)

- CIBIL is updated as “Settled”

- If repossessed vehicle is not auctioned yet, bank may release it

- Borrower receives closure documents

This marks the official legal end of the loan.

Is Auto Loan Settlement Legal?

YES — absolutely.

It is governed by:

- RBI guidelines on loan recovery

- Fair Practice Code (FPC)

- Banking Ombudsman regulations

Banks are legally allowed to settle overdue auto loans through compromise or OTS for borrowers in genuine hardship.

Benefits of Auto Loan Settlement

✔ Stop repossession threats

✔ Close loan with reduced amount

✔ Stop harassment and illegal recovery

✔ No risk of towing or seizure (post-legal representation)

✔ One-time solution to become debt-free

✔ Receive proper NOC + closure documents

✔ Reduce emotional and financial pressure

✔ Move forward without legal complications

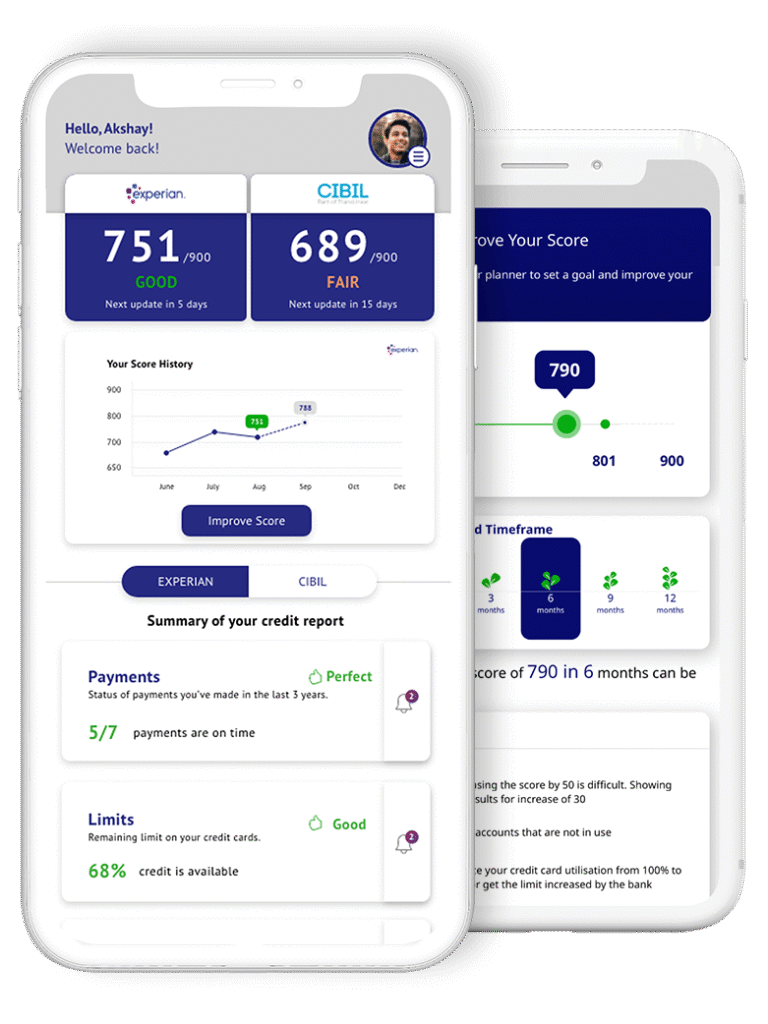

Impact on CIBIL Score

Your CIBIL score will temporarily reflect:

- “Settled” or “Closed – Settled”

- However:

- This is better than long-term default

- Better than repossession auction

- Better than legal litigation

- With proper guidance, borrowers can rebuild CIBIL within 12–18 months.

Documents Required for Auto Loan Settlement

- Aadhaar & PAN

- Loan agreement (if available)

- EMI statement & overdue details

- Recovery letters or repossession notice

- Vehicle RC, insurance, pollution certificate

- Credit report (CIBIL/Experian)

- Financial hardship proof

💬 FREQUENTLY ASKED QUESTIONS (FAQs)

Most overdue auto loans can be settled if there is genuine financial hardship and the vehicle’s

value does not justify legal action.

If legal representation is submitted, the bank must follow RBI norms.

Illegal seizures, midnight towing, or forceful recovery become challengeable.

Yes, temporarily.

But with proper planning, borrowers recover their score within 12–18 months.

Most settlements fall between:

➡️ 40% – 70% waiver (depending on bank, DPD, vehicle value)

Two possibilities:

If not auctioned yet: You may negotiate to get it released

If auctioned: The “shortfall amount” can be settled at a reduced value

No.

Your advisor handles all communication. You only make the final payment directly to the bank.

Yes.

NOC + Closure Statement are mandatory once the settlement amount is paid.

Yes, after rebuilding your CIBIL score. Most borrowers become eligible within 12–24 months.

Ignoring dues leads to:

Repossession

Legal notices

CIBIL damage

Auction of your vehicle

Additional penalty and charges

Settlement prevents all these risks.

Repossession: Bank takes the vehicle.

Settlement: You close the loan at a lower amount and avoid legal action.