HOME LOAN SETTLEMENT

What Is Home Loan Settlement?

Home Loan Settlement is a formal negotiation process where a bank agrees to close an

overdue home loan account at a reduced amount, based on the borrower’s financial hardship

and the bank’s recovery strategy.

Unlike credit card or personal loan settlement, home loan settlement is more sensitive because:

- The loan is secured by property

- The bank has the right to initiate

- SARFAESI proceedings

- Recovery involves legal notices, auction warnings, and possession risks

However, in genuine hardship situations—job loss, business failure, medical

emergencies—banks may agree to a negotiated settlement to avoid long litigation and recover a

fair amount quickly.

After the settlement amount is paid, the bank issues:

- A Settlement Letter

- A No Dues Certificate (NOC)

- Release of property documents

- Closure update on CIBIL

Why Do Banks Agree to Home Loan Settlement?

Banks and NBFCs follow RBI-guided frameworks for handling overdue and NPA accounts.

When a customer is unable to repay due to genuine difficulties such as:

Banks prefer settlement when the borrower demonstrates genuine and long-term inability to

repay the home loan EMIs.

Banks consider settlement when:

- The property value has fallen

- The NPA account is costly to maintain

- EMI default exceeds 90–180+ days

- The borrower has no repayment capacity

- Legal recovery is time-consuming

- Auction attempts have failed or are not feasible

It is financially beneficial for both sides:

- Bank → recovers a guaranteed amount

- Borrower → gets legal closure and relief

When Should Someone Consider Home Loan Settlement?

Home loan settlement is suitable for borrowers who:

- Are unable to pay EMIs for 3+ months

- Have received SARFAESI notice under Section 13(2)

- Are facing threat of property attachment or auction

- Have lost job or income source

- Are under heavy financial stress

- Are unable to restructure or top-up the loan

- Cannot regularize the overdue amount

- Are in a situation where foreclosure is not possible

If repayment is impossible and property auction is imminent, settlement becomes the safest

legal exit.

Types of Home Loan Settlement

Banks generally offer 3 types of settlements:

One-Time Settlement (OTS)

The borrower pays a negotiated lump sum amount within a fixed timeline.

Bank waives off interest, penalties, legal charges, and sometimes a part of principal.

Compromise Settlement

Offered in extreme hardship cases where:

No income source exists

Property value is deteriorated

EMI default is long

Legal recovery is not feasible

Bank accepts the maximum possible amount borrower can offer.

Settlement After Property Auction Shortfall

If a property is auctioned but the sale amount is less than the loan outstanding, the remaining

amount (shortfall) can also be settled.

The Complete Home Loan Settlement Process (Step-by-Step)

Complete Loan Assessment

We examine:

- Outstanding amount

- EMI history

- SARFAESI status

- Legal notices received

- Property valuation

- Borrower’s financial hardship

- DPD / NPA classification

This helps determine whether settlement is possible and what percentage reduction can be

achieved.

Legal Protection & Communication With Bank

Our legal team immediately:

- Issues representation to the bank

- Stops illegal recovery or harassment

- Ensures RBI recovery compliance

- Protects borrower from forced possession attempts without due process

This gives borrowers instant relief.

Calculating Settlement Window

We determine:

- Minimum settlement amount bank may accept

- Maximum waiver possible

- Whether full or partial waiver is feasible

- Whether restructuring is an alternative (if needed)

- Home loan settlements generally range between:

55% – 85% waiver (depending on property value, NPA stage, and hardship case).

Initiating Negotiation With Bank / Nodal Officer

We formally communicate with:

- Branch manager

- Recovery team

- SARFAESI legal officer

- Authorized officer under Section 13

- Nodal officer (for escalations)

Proper representation helps the bank treat the case seriously and evaluate settlement options.

Negotiation for Maximum Waiver

Our legal team negotiates for:

- Waiver of accumulated interest

- Waiver of legal charges

- Waiver of penalties

- Waiver of remaining principal (if hardship is severe)

- Reduction of outstanding amount

- A flexible settlement timeline

No payment is ever made until we receive a written settlement offer from the bank.

Settlement Payment & Legal Documentation

Once the borrower agrees to the negotiated amount:

- Payment is made directly to the bank

Bank issues:

✓ Settlement Letter

✓ Payment acknowledgment

✓ Closure statement

Property documents are released once the loan is fully settled.

NOC, CIBIL Update & Property Rights Restoration

After final payment:

- Bank issues a No

- Dues Certificate (NOC)

- Property documents are handed back

- CIBIL is updated

- SARFAESI proceedings are withdrawn

- Legal closure is completed

This ensures a clean, dispute-free resolution.

Is Home Loan Settlement Legal?

YES — it is legal and governed by:

- SARFAESI Act, 2002

- RBI guidelines on recoveryBanking

- Ombudsman provisions

Settlement is a formal, recognized banking remedy for borrowers experiencing unavoidable

financial hardship.

Benefits of Home Loan Settlement

✔ Stop auction risk

✔ Stop legal harassment

✔ Close loan with reduced amount

✔ Full legal closure & NOC

✔ Recover property documents

✔ Reduce emotional and financial stress

✔ Avoid long court battles

✔ Restore financial stability

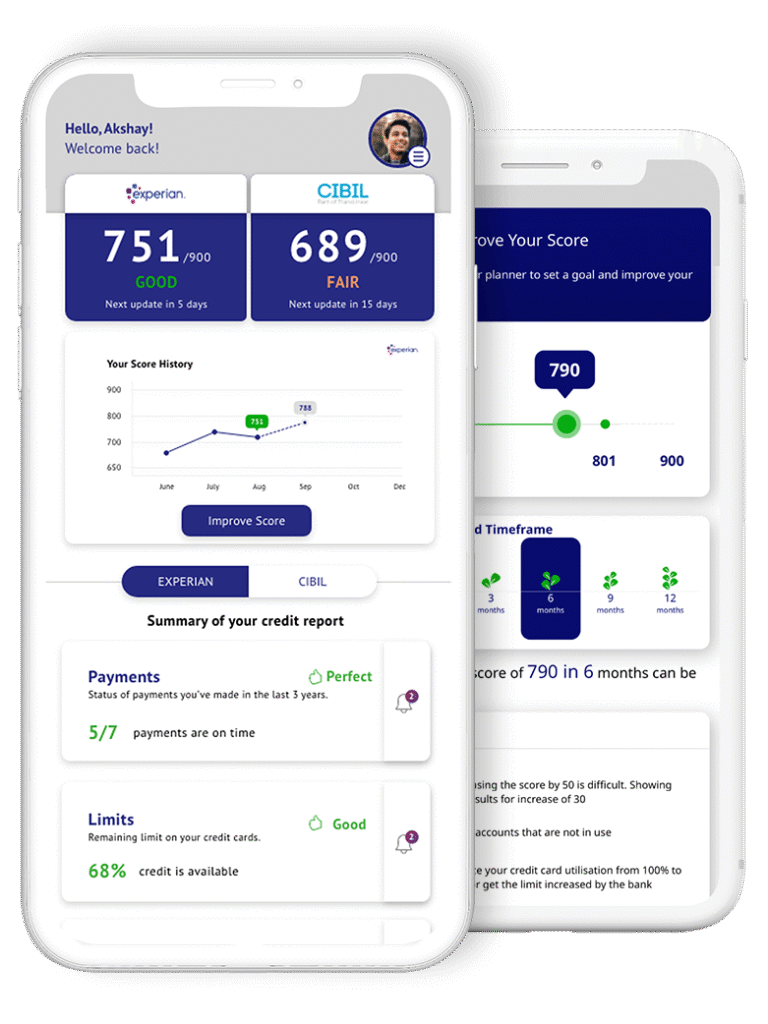

Impact on CIBIL Score

Yes, CIBIL score will temporarily drop because the loan will be reported as:

“Settled” or “Closed – Settled”

However, with proper financial discipline and a credit rebuild plan, borrowers can recover their

score within 12–24 months.

Settlement is still far better than:

Auction

Court cases

Long-term NPA record

Very low CIBIL for 5–7 years

Documents Required for Home Loan Settlement

- Aadhaar & PAN

- Loan agreement

- Property documents (if available)

- EMI statement & overdue details

- SARFAESI notices (13(2), 13(4), possession notices)

- Proof of financial hardship

- Recovery letters

💬 FREQUENTLY ASKED QUESTIONS (FAQs)

Not always. Settlement depends on:

Hardship level

Property value

NPA stage

Bank’s risk assessment

But most NPA accounts can be negotiated.

No, if settlement is approved before auction or possession.

Settlement protects you from losing the property.

Yes, but temporarily.

You can rebuild your score through structured financial planning.

Typical settlement ranges:

55%–85% waiver depending on property value, hardship, and DPD.

No — once legal representation is submitted, banks must follow SARFAESI procedure.

Any illegal possession attempt can be challenged legally

Restructuring: EMI reduced, loan continues

Settlement: One-time closure at reduced amount

If repayment is impossible, settlement is safer.

Yes. After settlement completion and NOC issuance, the bank releases all property documents.

Yes — after rebuilding CIBIL.

Most borrowers become eligible for new loans within 18–24 months.

You have 60 days to respond.

Settlement or restructuring can be requested immediately to prevent escalation to 13(4)

(possession notice).

Yes — if you take timely legal action and negotiate a settlement, auction/possession can be

prevented.