PERSONAL LOAN SETTLEMENT

What Is Personal Loan Settlement?

Personal Loan Settlement is a formal negotiation process where your bank or NBFC agrees to

close your overdue personal loan at a reduced amount due to proven financial hardship.

Unlike restructuring or refinancing, settlement is a one-time resolution where:

You pay only a part of the total outstanding, and

The bank waives off the remaining balance

After the settlement amount is paid, the bank issues:

A Settlement Letter

And later a No Dues Certificate (NOC)

This legally confirms the closure of your personal loan account.

Personal loan settlement is most effective for borrowers who are facing difficulty in repaying due

to unavoidable financial problems.

Why Banks Offer Personal Loan Settlement

Banks and NBFCs follow RBI-guided frameworks for handling overdue and NPA accounts.

When a customer is unable to repay due to genuine difficulties such as:

Job loss

Salary reduction

Business failure

Medical emergency

Unexpected financial crisis

The lender prefers settlement because:

- It recovers some money quickly

- It avoids expensive legal and recovery

- processes

It reduces the bank’s NPA burden - It closes high-risk accounts efficiently

Thus, personal loan settlement benefits both:

👉 The bank (faster recovery)

👉 The borrower (reduced liability)

When Should You Consider Personal Loan Settlement?

Settlement is ideal when:

- You are 60–90+ days overdue (DPD)

- EMIs are impossible to manage

- Legal notices or recovery pressure has started

- Outstanding balance is increasing due to interest and penalties

- You are facing a genuine hardship with no immediate recovery in income

- You want a one-time final resolution

- Your loan has already been assigned to recovery or legal team

If repayment is no longer possible, settlement is often the only safe and practical option.

Who Is Eligible for Personal Loan Settlement?

You are eligible if you can show genuine hardship such as:

- Job loss or pay cut

- Business shutdown

- Health issues or medical expenses

- Family emergency

- Loss of income source

- High debt burden from multiple loans

Banks approve settlement when your inability to pay is real, severe, and documented.

The Complete Personal Loan Settlement Process (Step-by-Step)

Case Assessment & Hardship Analysis

We begin with a deep review of your:

- Outstanding loan amount

- EMI history

- Overdue/DPD status

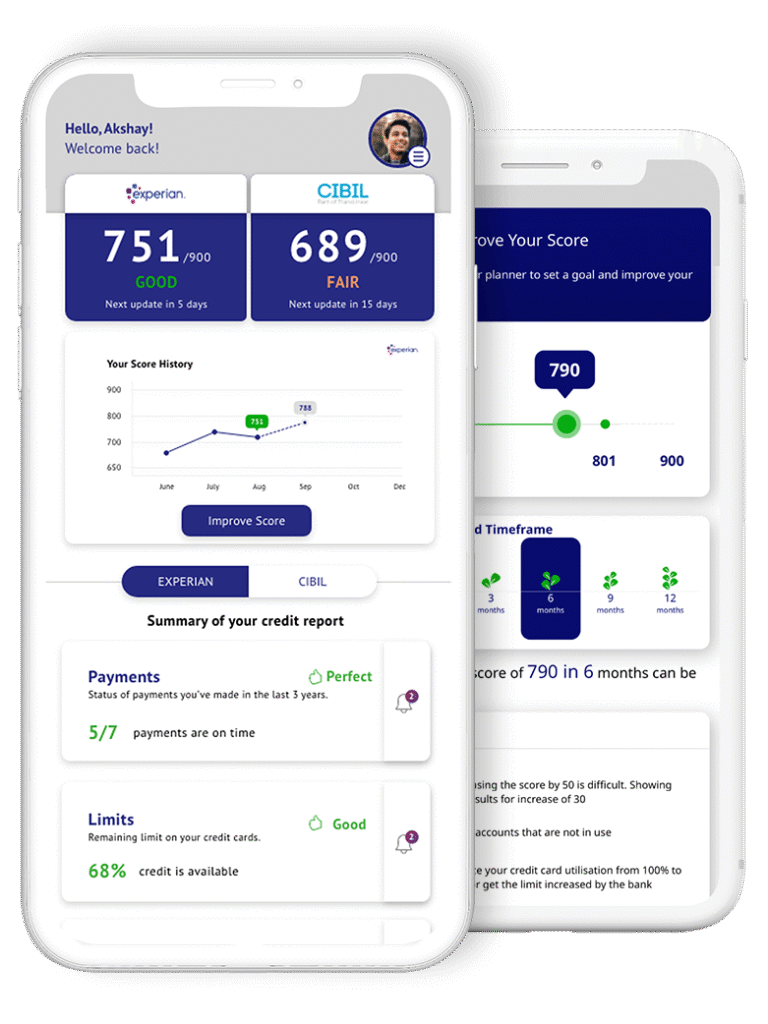

- Credit score

- Current income

- Hardship reason

- Bank/NBFC policy

This helps determine whether settlement is the most suitable option and what percentage

reduction is possible.

Legal Protection & Stopping Harassment Calls

Once your case is onboarded:

- We issue a legal intimation to the lender

- All recovery calls are directed to our team

- Threats, field visits, harassment stops

- You receive full protection under

- RBI recovery guidelines

This step alone gives clients massive peace of mind.

Calculation of Settlement Range

We evaluate:

- Minimum settlement value

- Maximum waiver achievable

- Bank’s internal policy

- Payment capacity of the borrower

- Personal loan settlements usually fall between 30%–55% of the total outstanding, depending

on: - DPD

- Risk profile

- Hardship strength

- Bank/NBFC flexibility

Initiating the Case With Lender / Recovery Team / Nodal Officer

We formally open communication with:

- Bank’s collections manager

- Recovery agency (if assigned)

- Grievance Redressal Officer

- Principal Nodal Officer (PNO), if escalation is needed

This ensures your case is handled professionally at the correct level.

Negotiation for Maximum Reduction

Our experienced settlement specialists negotiate for:

- Maximum waiver of interest

- Maximum waiver of penalties

- Principal reduction (in severe hardship cases)

- Approval for split-payment settlement if required

No payment is ever made unless a written settlement letter is issued by the bank.

Payment to Bank (NOT any Recovery Agent)

Once terms are approved:

- You pay directly to the bank’s official account

- NEFT/RTGS/UPI/DD — depending on bank’s guidelines

- Written acknowledgment is taken

- Recovery stops permanently

This ensures safety, transparency, and legal validity

Loan Closure: NOC & CIBIL Update

After full payment:

- Bank issues a No Dues Certificate (NOC)

- Your personal loan is marked as closed

- CIBIL updates the account status

- We guide you in rebuilding credit score gradually

This marks the official end of the loan.

Is Personal Loan Settlement Legal?

YES — it is 100% legal.

It is supported by:

- RBI guidelines

Banking - Ombudsman rules

- Standard practices of all Indian banks/NBFCs

- Settlement is a formal, lawful method to close overdue personal loans for customers in genuine

hardship.

Benefits of Personal Loan Settlement

✔ Reduce your total liability

✔ Stop harassment immediately

✔ Avoid legal escalation

✔ Clear debt in a one-time payment

✔ Receive proper settlement letter + NOC

✔ Lower emotional stress

✔ Improve financial stability

✔ Rebuild CIBIL with guidance

This gives borrowers a chance to reset their financial life.

Impact on CIBIL Score

- Yes, settlement affects the score temporarily.

- Your loan will be marked as “Settled”

- Score may reduce initially

- Over the next 6–12 months, with the right guidance, you can rebuild to a healthy score

- However, settlement is still better than:

- Continuous defaults

- Court cases

- Unpaid NPAs staying on record for years

Documents Required

- PAN & Aadhaar

- Loan agreement (if available)

- EMI/overdue statement

- Credit report (CIBIL/Experian)

- Recovery notices (if any)

- Proof of financial hardship

💬 FREQUENTLY ASKED QUESTIONS (FAQs)

Most overdue personal loans can be settled, especially after 60–90+ days of default. Approval

depends on your hardship and bank policy.

Yes. Once we send legal intimation, the bank must follow RBI recovery guidelines, and

harassment stops immediately.

Yes, temporarily.

But with proper rebuilding steps, your score can recover to 700+ within months.

Most settlements fall between 30%–55% of outstanding. Severe hardship cases may get an

even higher waiver.

Banks prefer one-time payments, but many allow 2–3 split payments depending on negotiation.

100% YES.

It is an officially accepted solution under Indian banking rules for customers facing genuine

financial hardship.

Yes. The No Dues Certificate is issued once the agreed settlement amount is paid.

Yes — with proper CIBIL rebuilding. Many borrowers become eligible for new loans within

12–18 months.

Ignoring dues may lead to:

Legal notices

Heavy penalties

Long-term CIBIL damage

Possible field visits

Account classification as NPA

Settlement avoids these risks.

Restructuring: EMI is reduced; loan continues.

Settlement: One-time payment; remaining amount waived; account closed.